In a New Era of Investing, Gender and Generational Gaps Remain

Robinhood partners with Patrice Washington to shine a light on the state of women and the new generation of investors.

Over the last year, we have seen monumental shifts in every part of our lives – from how we live, to how we work, to how we save. As we close out the year, we took a step back to see how Americans are thinking about investing and how that differs across gender and generations. To do this, we conducted a survey with Morning Consult to look at investors across the nation and compare their investing habits, behaviors and perceptions. The difference is clear:

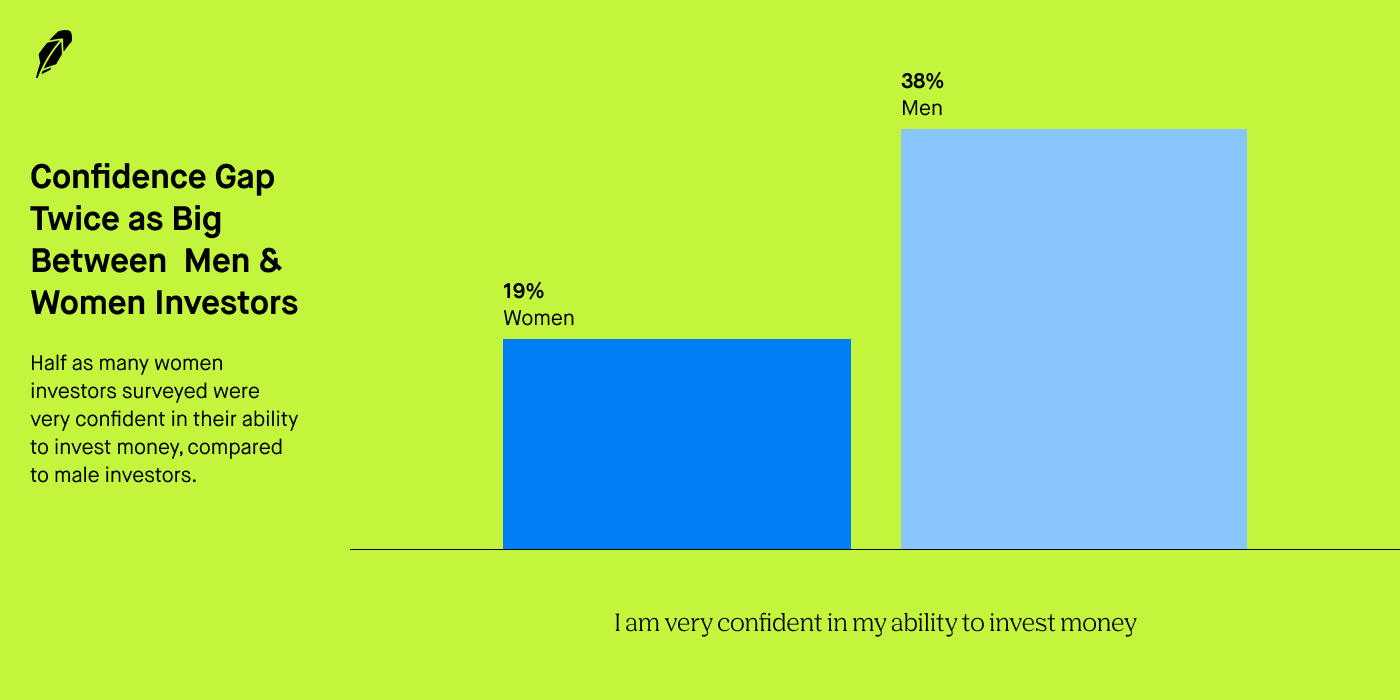

- The gender investing confidence gap remains. Only 19% of women investors said they were very confident in their ability to invest money, compared to 38% of male investors.

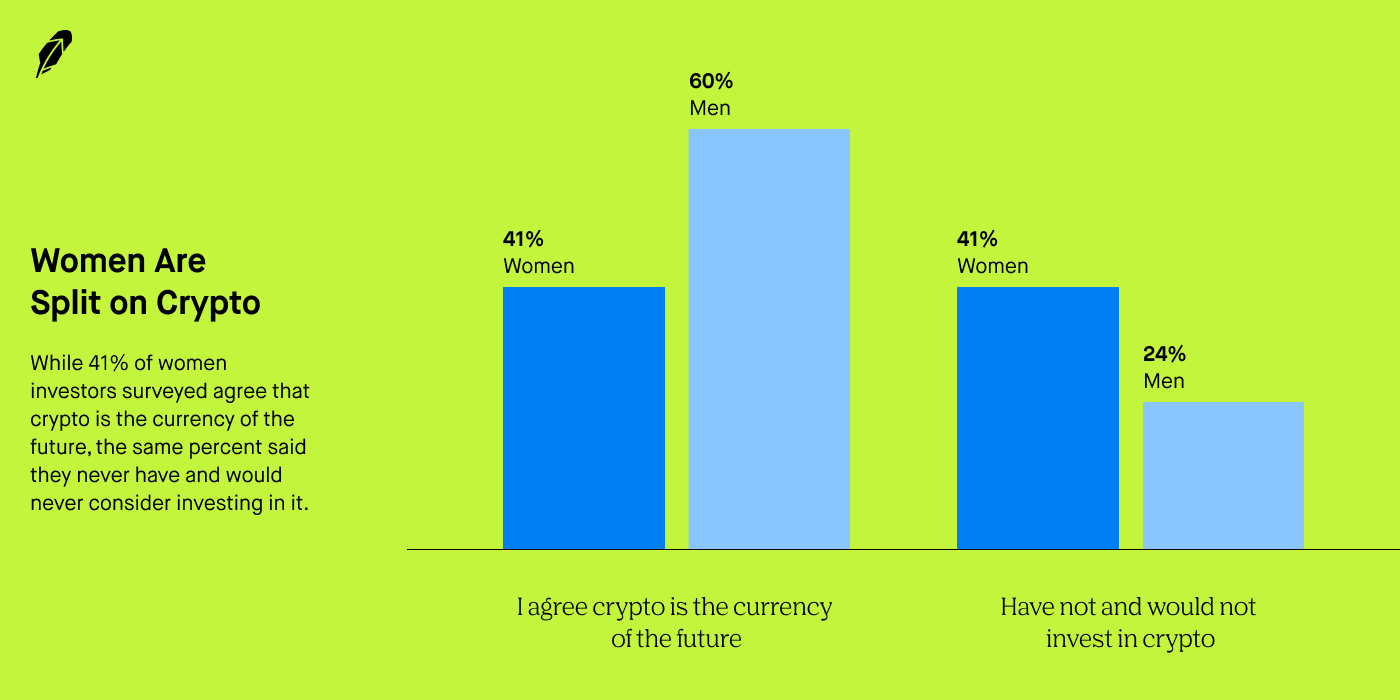

- Women are split on crypto. While 41% of women investors agree that crypto is the currency of the future, 41% of women investors also said they never have and never would invest in crypto.

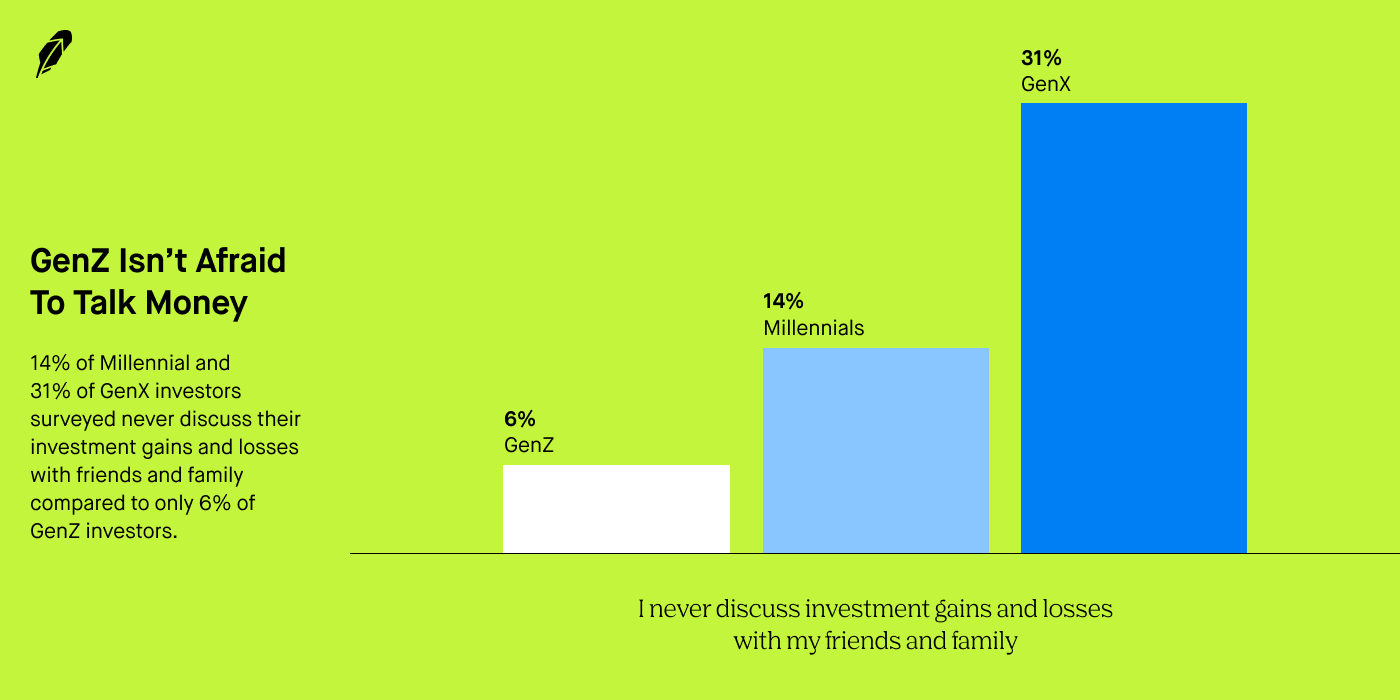

- GenZ isn’t afraid to talk about money. Only 6% of GenZ investors said they don’t openly discuss their finances and investment gains and losses compared to 14% of Millennials and 31% of GenX investors.

To dig more into what this means, we partnered with Patrice Washington, award-winning author and host of the Redefining Wealth Podcast. Here is what we learned.

The Confidence Barrier to Investing

Our survey showed that men are twice as likely to feel very confident in their ability to invest money compared to women.

However, as Patrice points out, “we know women are investing for the future and often see better returns because of their intentionality, consistency and patience. Just because women don’t feel as confident it doesn’t mean that they aren’t necessarily proficient once they begin. As women, we can be harder on ourselves and believe that to be good at something that we need to have mastered every single aspect and that’s not true.”

Despite the confidence gap, our survey found that women are investing for their long term financial goals. 73% of women said retirement was the top financial goal for their investments. Meanwhile, 59% said they hold individual stocks they own on average for at least a year or longer.

Investing can be a powerful tool for building and accumulating wealth – but there’s still barriers holding some back from getting started. 58% of women believed not having enough money to invest is the biggest barrier that stops new investors from starting and more than 40% of women believed it was not knowing how to start, not feeling confident in investing decision-making and lastly, feeling intimidated by the industry – a barrier which 10% more women than men believed was holding new investors back.

It’s clear that financial education is the foundation of financial empowerment. “Committing to a budget, debt elimination, savings and understanding credit already takes up so much bandwidth because basic financial literacy in this country is still a luxury,” says Patrice. “If the basics were taught in high school and college, by the time women had more access to disposable income, investing would be a natural next step. Instead many of us are playing catch up. Clarity breeds confidence and more education should be given to help women acknowledge and recognize how great they actually are with investing.”

We’re determined to continue lowering barriers to investing through educational tools like lessons to help more people learn the basics, right in our app, on topics like why people invest, what the stock market is and how it works, and how to define your investing goals.

The Crypto Divide

Crypto is hot this year, but the gender divide remains. Our survey showed that compared to men, less women said that they knew about investing in cryptocurrency and were also less likely to see it as a better investment.

From the investors surveyed, only 11% of women said they knew a lot about cryptocurrency, compared to 29% of men. And while 41% of women and 60% of men agree that it is the currency of the future, a staggering 41% of women investors said they never have and never would invest in cryptocurrency — compared to only 24% of men who responded the same way.

Patrice notes, “The road to financial empowerment begins with getting started and is paved along the way by taking the next best step forward. This idea that we need to have mastered every single aspect of something before we even start is simply not true. Not knowing about every detail about every cryptocurrency does not mean that you can’t be an investor.” Despite the gaps, we’ve seen some signals the tide is changing. In March, we reported that the number of women actively trading on Robinhood Crypto had grown seven times compared to the number at the end of 2020, indicating that more women are looking at crypto as a part of their financial strategy.

How the Generations Trade

We’re seeing a generational shift towards more open conversations about money. For GenZ, money and finances are no longer off-limits. Only 6% of GenZ said they don’t openly discuss their investment gains and losses with friends and family, compared to 31% of GenX and 14% of Millennials who say these conversations are off-limits for them.

The way we get information has also changed in every aspect of our lives, including finance. 42% of GenZers and 43% of Millennials said they use finance experts on social media to help make investment decisions, compared to 27% of all investors.

We also see a difference in how different generations invest. 16% of GenZ investors say they hold individual stock they own on average for a day or less, a huge difference compared to just 1% of Millennials and GenX who do the same. 60% of GenX and a third of Millennials said they hold their stock for a year or longer on average – something only 19% of GenZ said they do.

Where do we go from here?

The stock market is one of the biggest engines for economic growth. We believe we are all investors, and we’ll keep working to help give more people the information, access, and ability to build wealth.

Methodology

The Retail Investors poll was commissioned by Robinhood and conducted by Morning Consult between August 26 – August 29, 2021 among a sample of 2200 Adults. The data is weighted to reflect the American Retail Investor population. Results from the full sample have a margin of error of +/- 2%. “Retail Investors” are defined as those who currently have a brokerage or trading account in which someone trades at least one of the following: stock in individual companies, mutual funds, options, bonds, cryptocurrency, and/or ETFs. Results by gender are based on self-identification by survey respondents. Sample size of gender non-conforming individuals is not statistically significant.

All investments involve risks, including possible loss of principal. Robinhood compensated Patrice Washington for her views and interpretation of the Retail Investors survey results.